The crypto market has undergone a tough patch in July, with Bitcoin (BTC) the hardest hit despite reaching a new high in mid-July. However, analysts see August as a significant month for the altcoin ecosystem.

Below are their top picks for August, with many predicting that some of these digital assets will set new all-time highs after their flip-flop performance last month.

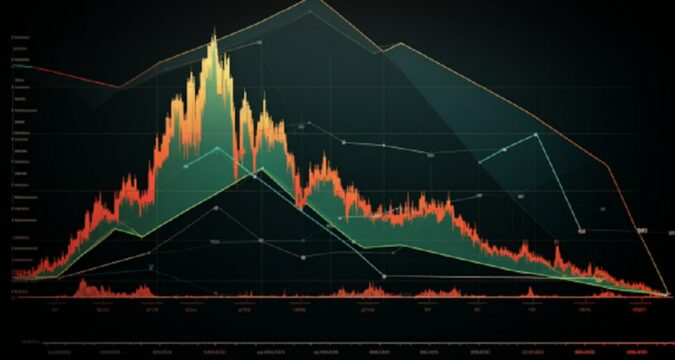

OKB’s Possible Price Wave Movement

Since the summer of 2022, the price of OKB has been on an incredible rise, resembling a captivating five-wave surge. Currently, the token is in the fourth wave of the Elliott Wave sequence.

Moreover, the widely-used Elliott Wave theory serves as a guiding compass for technical analysts looking to uncover enduring price patterns, comprehend the intricate interplay of investor sentiment, and gain invaluable insights into the route of the prevailing trend.

Thus, if their interpretation of this theory for OKB is correct, there should be an impending breakout for OKB’s price. It should exit its current triangle and surge toward the next resistance level at the $72.10 price threshold.

The analysis of the 1.61 Fibonacci extension on wave four further confirms this price point as the next resist resistance level. If OKB reaches this price target, it will be its new all-time high price.

However, this bullish prediction for OKB will be invalid if the price breaks below this triangular pattern and not above it. OKB’s next support level will be the $34.3 price level if that happens.

MKR Making Moves Towards Trading At Over $1,000

In July, the Maker (MKR)’s price experienced two significant bullish events that substantially impacted its price trajectory. Accordingly, it has managed to break free from a descending resistance line that had held it back for 790 days.

This recent breakthrough is a strong indication of a bullish market trend. Moreover, it surpassed the critical $1,000 horizontal resistance during the same period, reinforcing the previous bullish sentiment.

However, MKR’s next significant resistance level is the $2,100 price point. This price represents a substantial 70% increase over its current value.

However, analysts opine that a 410% increase above its current price may be difficult for OKB to attain, and the $2,100 mark is a more attainable target for the asset. Even with this bullish price forecast, a close below the $1,000 threshold will invalidate the positive expectation.

If this bullish prediction is invalidated, MKR’s closest support will be at the $750 price point.

OCEAN Makes Another Breakout Move

Since reaching an all-time high of $1.94 in April 2021, OCEAN’s price has struggled to find upward momentum. It remains below a descending resistance line and has remained there for more than 829 days.

Interestingly, OCEAN has made six unsuccessful attempts to break out from this resistance zone, indicating that a breakout will happen sooner than later. Hence, there is reason to be optimistic about OCEAN’s prospects.

OCEAN’s price has also remained within a descending parallel channel since the beginning of February. These two patterns suggest a high probability of a price breakout.

The repeated attempts to break through the resistance line weaken the long-term barrier, paving the way for a possible bullish breakout.

TOMO ‘s Path To A New All-Time High

TOMO price is currently showing signs of a bullish trend, with the primary contributing factor being its remarkable 450% increase since the start of the year. During this impressive surge, TOMO broke above the significant resistance area to trade at the $0.95 price level.

This level is vital because it represents the last horizontal resistance before the asset’s path toward reaching an all-time high of $3.90. Additionally, the wave count analysis suggests that the price may reach a new all-time high in the next few months.

According to the wave count, the price is currently in the fifth and final wave of the upward movement that began at the start of the year.