Coinibank

-

Overall Score

Summary

It is easy for any trader, whether they are a novice or an experienced trader, to determine that Coinibank is a reliable and genuine choice as a broker. It offers an array of assets, excellent trading conditions and the kind of features and services that make it a good choice for starting your trading career.

Coinibank Review

Are you tired of your 9-to-5 job? Do you want to supplement your existing income? No matter what the reason, a lot of people are turning to the world of trading for earning money. Trading is not a new concept; it has existed for decades and markets like foreign exchange and the stock market have helped thousands of people earn massive amounts of money in a short span of time. This high return on investment in a relatively short time period has only added to the appeal of trading. These days, this profession has also evolved like the rest in this digital world and now you can trade online.

As a matter of fact, it has become extremely convenient for people to enter these markets because they can easily find brokerages online. With the hassle of going out eliminated and the potential of earning high profits, it is not surprising that the trading markets have experienced a surge. If you are also interested, you can get started easily, even without any experience. But, you will first have to find a broker to provide you with access to all that you need to begin. Online brokers are plentiful in the market and this only adds to the challenge of finding the right broker.

No two brokerages are the same, but all of them claim to offer the best trading services to their clients. To add to it, the number of scam brokers has also gone up, which has added a layer of difficulty to this decision. Using a brokerage means sharing your personal information with them to open an account and depositing funds to trade. If they are scammers, they can take your funds and even sell your information to others or use it for identity theft. To avoid these consequences, you need to assess every broker carefully before making a selection.

If you do your due diligence and thoroughly check a broker’s offerings, it will become apparent if they are legitimate or only interested in scamming people. Coinibank is a name that will pop out when you start your search for an efficient online trading broker. But, can you rely on it? The only way to find out is to check its offerings carefully.

Overview of Coinibank

Coinibank is an online brokerage that offers its traders the opportunity to invest in a variety of instruments in one place. The broker was introduced by a team of people who have years of experience in the world of forex trading. These industry experts are well-versed in the ins and out of trading and what tools and services are required for an optimal trading experience. The broker offers its clients access to the forex exchange market, along with a huge number of CFDs, to help them in diversifying their portfolio.

One of the top reasons that Coinibank has seen an increase in its popularity, even though it is relatively new, is because of its dedication to its clients. The broker has tailored its offerings according to the needs of every trader, whether beginner or expert, and aims to achieve 100% client satisfaction. Furthermore, they continue to improve their services by making upgrades and changes, according to market trends and changes, which further facilitates the traders.

Coinibank’s Asset Offerings

Trading involves investing your money in trading instruments and profiting from their price movements. But, which instrument do you want to trade? There are thousands of options available, but some traders are interested in a specific instrument. Some prefer to trade multiple instruments at the same time because this diversification can reduce their risk. No matter what kind of trader you are, you should ascertain if a broker offers you the trading instruments you are looking for. You will definitely not be disappointed with Coinibank’s asset index because the broker has added a horde of options to accommodate as many traders as possible. Some of the assets that you can trade with Coinibank are:

- Forex

There are a multitude of forex currency pairs that you can find at Coinibank and the broker also provides access to numerous tools to help you in trading them. You can choose between major and minor currency pairs and there are some rare ones also available. Some of the options you can explore are AUD/CAD, EUR/CAD, EUR/GBP, EUR/NZD, CHF/JPY, AUD/USD, CAD/CHF, GBP/USD and NZD/USD.

- Indices

With Coinibank, traders also have the opportunity of trading some of the top indices in the world, such as DAX, FTSE, Nasdaq, S&P, DOW and Nikkei. You can enjoy leveraged trading and invest as much as you want.

- Commodities

Traders have the option of trading both soft and hard commodities via Coinibank. If you are interested in precious metals, the broker gives you the option of investing in copper, gold, silver, platinum and more. If energies are appeal to you, the broker has natural gas, RBOB gasoline and Brent crude oil available. Other agricultural commodities that you can also trade include corn, coffee, cocoa, sugar, wheat, cotton and soybeans.

Another great addition to Coinibank’s asset index is that of stocks. The broker gives you the opportunity of trading stocks of some of the leading companies in the world. Some of the prominent names include Nintendo, Carrefour, Loreal, BMW, Deutsche Bank, Fiat, Volkswagen, Barclays, Vodafone, HSBC Holdings, Amazon, Alibaba Group, Apple and AT&T.

Apart from these assets, Coinibank also provides its clients the opportunity of trading various bonds and ETFs. This allows everyone to create a diversified portfolio, ensuring that risks are as controlled as possible and improving the chances of high returns.

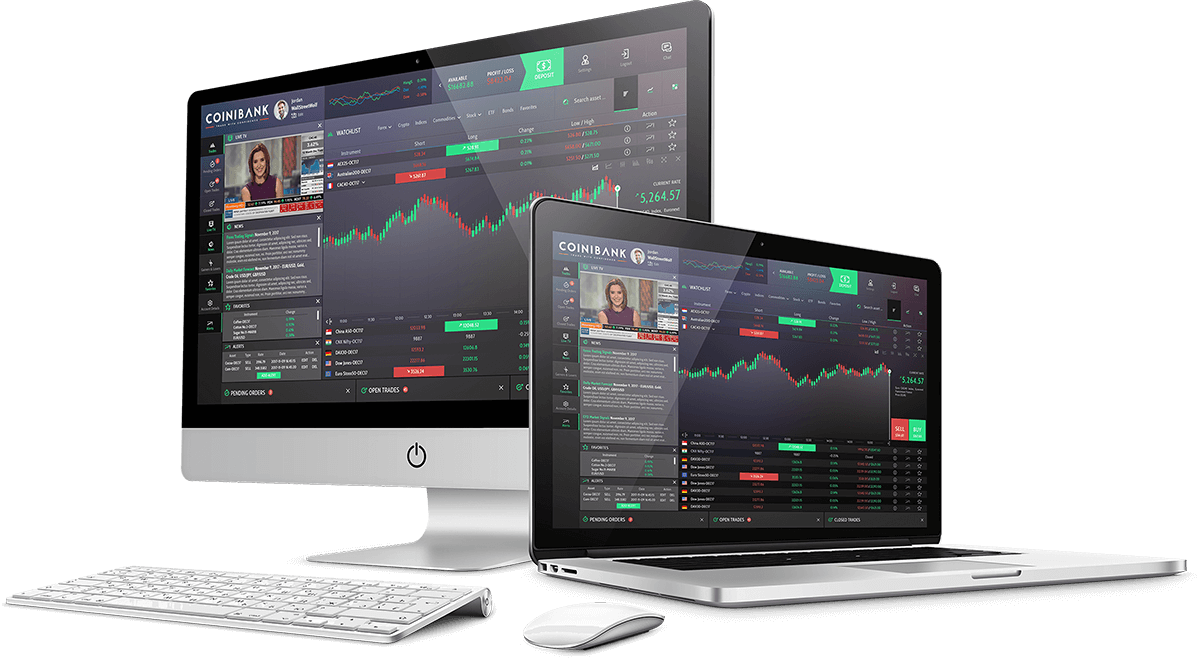

Coinibank’s Trading Platform

The trading software acts as a gateway to the trading world as it is used for executing transactions, monitoring different trades and keeping track of your portfolio. Every broker offers a trading platform of their choice and Coinibank has done the same. It has come up with an advanced trading platform that can be accessed from any device, whether it is a PC, notebook, mobile or tablet device. This is due to the fact that the broker has come up with a web-based platform that you access just by logging onto their website.

Absolutely no download is required, which adds to the convenience of the users and it boasts a user-friendly and interactive interface that eliminates any learning curve. Powered by sophisticated technology, Coinibank’s trading platform offers quick execution and has been equipped with an array of tools and trading orders to assist traders in earning profits. You can take advantage of one-click trading, view all your trading activity in one place and use advanced technical analysis tools. To facilitate their traders even further, Coinibank has also added mobile trading apps for both iOS and Android devices. Traders can stay connected to the market through their mobile devices and never miss a trading opportunity. The apps also boast all the unique features and tools that you can find on the web trading platform, ensuring a smooth trading experience for everyone.

Coinibank’s Easy Registration

People turn to trading to take advantage of its ease and simplicity, but signing up with brokers can often be a headache because of the long procedures involved. Coinibank has tried to make it easy for all their clients by cutting down the hassles associated with registration and keeping the process as straightforward as possible. To register with the broker, you are only asked to provide some essential details like name, email address, a password, your location and phone number. As long as you are over 18, you will have no problem in having your registration accepted.

There is a verification procedure implemented by Coinibank for the security and safety of their clients. It is part of the KYC (Know Your Customer) policy and traders are required to submit documents for giving Proof of Identity and Proof of Residence to the broker. The purpose is to ensure that only legitimate traders are using Coinibank for trading and no scammers, frauds, hackers or other shady individuals can access the platform. Proof of Identity requires a national ID card, driver’s license or passport whereas any utility bill, bank statement or affidavit showing name and address will suffice for Proof of Residence.

It is essential for traders to complete this verification procedure if they want to deposit and withdraw funds to their account on Coinibank.

Coinibank’s Account Choices

After the registration process is completed, traders have to open an account with Coinibank. Every broker offers some account choices to its clients, which offer different features, depending on what type of trader they are designed for. Coinibank has taken this a step forward by offering six diverse account choices to their traders, whereas most brokers don’t go past three or four choices. This gives more freedom to traders to open an account that seems suitable for them. Let’s take a look at the account choices:

- Basic

Starting with the Basic account, Coinibank has set the minimum deposit at $250. It is meant for newcomers in the trading market due to which it involves a welcome bonus of 20%, an account manager for guidance, education center access for training and 24/5 customer support for assistance.

- Standard

The second account option at Coinibank is the Standard account and is for traders who are a step up from newbies. A minimum deposit of $2,500 has been set for this account and it provides all features of the basic account, along with the addition of trading alerts. The welcome bonus in this account is also increased to 25%.

- Silver

Coinibank’s third account is for intermediate traders and it can be opened with a minimum deposit of $5,000. In this account, the broker increases the welcome bonus to 30%. In addition, traders are now given a senior account manager as their trading volume increases. They can also attend live webinars for learning more about the financial markets from experts.

- Gold

The gold account option was introduced by Coinibank for serious account traders and it can be opened with a deposit of $10,000. The broker has increased the welcome bonus to 40% in this account and traders are also given the option of attending expert analyst trading sessions for expanding their knowledge about the market. There is no withdrawal fee applicable for traders under this account.

- Platinum

Coinibank has catered to skilled traders with the introduction of the Platinum account. They have to deposit at least $25,000 to open it and are given a welcome bonus of 50%. Features of all the above mentioned accounts are provided under this one with the addition of VIP services.

- VIP

The last account choice that you will come across at Coinibank is referred to as the VIP account and is for professional traders with a huge daily trading volume. The deposit requirement for this account is increased to $50,000 to ensure only pros opt for it. These traders are provided with daily personal trading sessions and they are also given a free saving account as a perk.

Coinibank Deposits and Withdrawal Policies

When traders have chosen an account they want to open with a broker, their next step would be to add funds so they can start trading. In order to do that, they will have to check out the payment solutions that a broker is offering. There are different options that are provided by brokers to their clients and you can check them out to select one as per their preference. Coinibank has also added various deposit and withdrawal methods for their clients and you will certainly appreciate their deposit and withdrawal policies.

There are no charges associated with deposits, no matter what method you choose. You can add funds via bank wire transfer, use debit and credit cards or choose e-payment solutions. Coinibank does not charge you anything for depositing funds, but third parties like banks may have their own charges. You can deposit as much as you like, with a minimum deposit of $250 requires for account opening. When it comes to withdrawals, it is important to note that your account should be verified for a withdrawal request to be processed. A minimum withdrawal limit of $50 is applicable for every transaction.

The withdrawal request is usually processed within six working days. The charges associated with withdrawal vary according to the method being used as does the processing time. You can select a method that offers you what you need.

Coinibank Savings Account

If you don’t want to trade, but have some money to invest, Coinibank gives you the option of opening a Savings account with them. This allows people to earn money in the form of interest, as you do when you put your money in a bank account. However, Coinibank is able to offer a better and higher return and they have different savings account choices also available. You can choose an account type based on how much you are willing to deposit and the broker will provide you with a return, depending on how long you leave the money. The options that are given include:

- Silver

This is the first savings account option and you can opt for this with a deposit of $5,000. Coinibank offers a 0.5% interest rate for six months, 1.2% interest for 12 months and 1.8% for 2 years.

- Gold

The second savings account option you will find at Coinibank is the Silver account and a minimum deposit of $10,000 is needed for it. The six month interest rate for this account is 1.2%, for 12 months it is 1.8% and it is further increased to 2% for 24 months.

- Platinum

Coinibank’s third savings account option for its clients is called Platinum and you have to deposit $25,000 for opening it. The interest you will receive under this account is 1.4%, 1.9% and 2.5% for six months, 12 months and 2 years, respectively.

- VIP

The last savings account option that Coinibank offers to its clients is called VIP and its deposit requirement is set at $50,000. The highest interest rates are paid under this account, which start at 1.8% for six months, 2.5% for a year and 3% if you deposit for 24 months.

Traders can choose to deposit their profits in a savings account in order to continue earning while managing their trading account separately. This allows them to earn through two sources, something they cannot do with other brokers.

Coinibank’s Security and Privacy Policies

Before you finalize your decision about choosing a broker, it is of the utmost importance to take a look at their security and privacy policies. In fact, these policies are often used to distinguish legitimate brokers from shady and unregulated ones. With Coinibank, you don’t need to be concerned because the broker has paid a great deal of time and attention in devising their security and privacy policies. To provide maximum protection to its clients, they have used the most advanced encryption for protecting all data that’s shared by them.

As soon as clients share any data, it is immediately encrypted and is not accessible to everyone. Strong firewalls are also used for keeping the website secure and to prevent hackers from attacking the system. Under the privacy policy, Coinibank has also stated that no personal or confidential data is shared with any third parties and neither is it rented or sold without consent. You can rest assured that your information will not go anywhere without your permission.

Apart from that, Coinibank is also compliant with Know Your Customer (KYC) policy as mentioned above, and also follows the guidelines of AML (Anti-Money Laundering) policy. Traders can only add funds from accounts in their own name and the same applies to withdrawal. In addition, they are allowed to deposit and withdraw from the same method for their security.

Coinibank’s Support and Assistance

As stated earlier, Coinibank is dedicated to providing 100% customer satisfaction and the broker has made this evident from all the features and services they have incorporated on their platform. To provide assistance and guidance to their clients, a complete Education Center has been created on the broker’s website. It comprises of detailed and in-depth educational resources in the form of e-books, videos and tutorials that can provide every trader with guidance and information about different aspects of trading. The resources are not just useful for newbies; even experienced traders can take advantage of them, especially through live webinars.

These are conducted by expert and professional traders in the market and are a great learning opportunity. Expert analysts are also available for giving advice and recommendations. Coinibank has also added a range of trading tools to their trading platform to assist every trader in achieving their goal of high returns. There are risk management tools like stop loss and take profit, which can help traders in protecting the profits they have made and keeping their losses under a certain limit. The broker also provides access to the latest news in the financial market to help in decision-making.

Moreover, Coinibank also understands that traders may have tons of questions or problems when they are using their trading platform or other features. They often require assistance and to ensure they can get help, the broker has developed a robust customer support system. There is an FAQ section on the website, which provides answers to any questions that traders are known to have routinely. If you are unable to find a solution, Coinibank has also given the option of getting in touch with their representatives through different means. You can use the email address provided or get in touch via phone for getting your issue resolved.

Conclusion

By investigating these different aspects of Coinibank, it is easy for any trader, whether they are a novice or an experienced trader, to determine that the broker is a reliable and genuine choice. It offers an array of assets, excellent trading conditions and the kind of features and services that make it a good choice for starting your trading career.